BUSINESS

Court Declares Aiteo’s Boss, Benedict Peters Earnings, Assets As Legitimate…Clears Him Of Multiple Money Laundering Charges

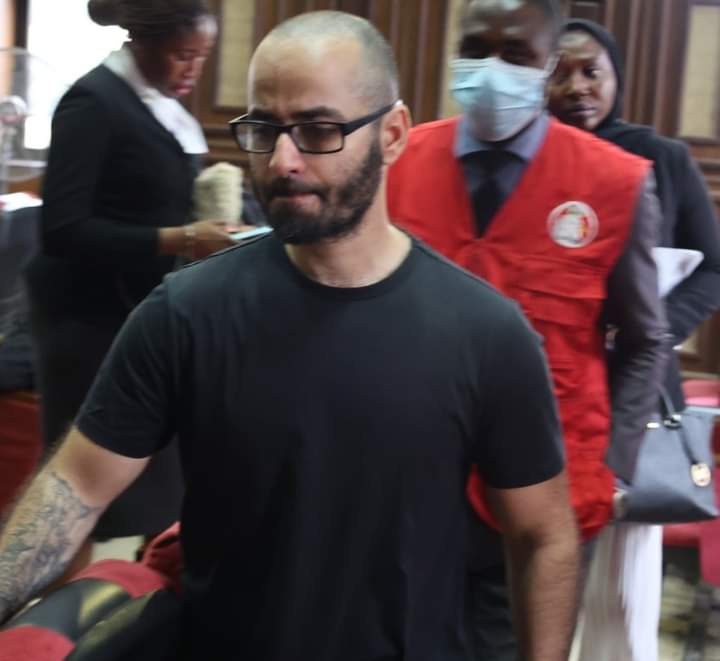

Mr. Benedict Peters

A High Court sitting at the Federal Capital Territory, Abuja has declared that earnings and assets accruing to oil magnate and Aiteo Energy boss, Benedict Peters were acquired legally through legitimate sources.

This follows a similar ruling squashing multiple money laundering charges and bribery of election officials indictment against Mr. Peters.

Justice Valentine Ashi declared this on Thursday, 7 of December, 2017 while pronouncing judgment in proceedings brought before him, challenging the provenance and legality of the ownership of assets and properties belonging to the Aiteo boss.

There was no evidence to support the suggestion that any aspect of his business showed any criminal conduct and as such, the allegations were declared as baseless.

BigPen Online recalls that the Plaintiff, Moses Uyah in a suit number FCT/HC/CV/ 0091/ 17, had alleged that Peters’ acquisition of a number of assets was fraudulent because he was unable to account for income or earnings from which such purchases could have been lawfully funded.

In consequence, he asked the court not only to find that Peters’ acquisitions of the properties were illegitimate; that he was also living above his means and that the funds utilized for the purchases were the proceeds of corrupt as well as illegitimate dealings.

Given the criminal acquisitions, he asked the court to forfeit the assets to the Federal Government.

But Peters, in response, willingly produced to the court evidence to demonstrate his sound business practices over the past 25 years in the oil and gas industry.

As well he provided evidence from financial institutions for funding raised over several years which allowed him to invest and conduct business that resulted to the considerable success of Aiteo Group.

Justice Ashi found that on said evidence produced to the court, Peters had established that he had a credible and verifiable means of livelihood; had substantial personal wealth to fund, did legitimately fund the acquisition of the properties identified in the proceedings and therefore could not be accused of living above his means.

The court also established, in the proceedings, that there was no evidence to support the suggestion that any aspect of his business showed any criminal conduct and as such, the plaintiff’s allegations were baseless.

In dismissing the case, Justice Ashi ruled that the “said assets and properties having been legitimately acquired by the defendant cannot be forfeited to the Government under any circumstances.”

The court ruled, “restraining any person, security agency or authority from disturbing the defendant’s quiet enjoyment of his assets and properties having been found to be legitimately acquired.”

In upholding Peters evidence and contention, the learned judge found that there was no merit in the allegations of criminal conduct relied upon by Uyah and the case as a whole.

In doing so, the judge observed “…that in the absence of any specific offence and proof of commission of crime, the defendant legitimately and lawfully acquired the assets and properties, the subject matter of this suit…”

The assets listed include 58 Harley House, Marylebone Road, London worth 2,800,000 million pounds, apartment 4, 5, Arlington Street, London worth 11,800,000 million pounds, Flat 5, 83-86, Prince Albert Road, London worth 3,750,000 million pounds and also other assets of Aiteo Energy Resources worth over $4.023billion.

Also listed by and affected by the judgment are monies in Account No 105277 in FBN Bank (UK) in the name of Mr. B and Mrs. N. Peters, monies in Account No 107127 in FBN Bank (UK) of Walworth Properties Ltd, the sum of 36,674.7 pounds held on behalf of defendant in the client Account of Clyde and Co. LLP, London, the sum of 40,620 pounds held in the correspondent Bank Account at Ghana International Bank, London and shares in Walworth Properties Limited, Rosewood Investments and Colinwood Limited.

[Widget_Twitter id=”1″]